43 payment coupon for irs

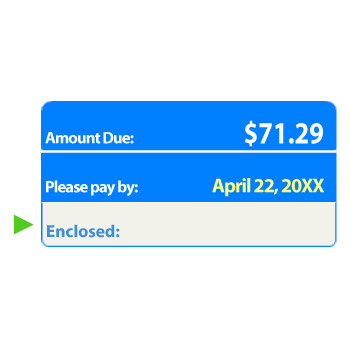

PDF Form 656-PPV Offer in Compromise - Periodic Payment Voucher Offer in Compromise - Periodic Payment Voucher. If you filed an offer in compromise (offer) and the offered amount is to be paid within 6 to 24 months (Periodic Payment Offer) you must ... Mail your voucher and payment to: Memphis IRS Center COIC Unit . AMC-Stop 880, P.O. Box 30834 Memphis, TN 38130-0834 1-844-398-5025 . Brookhaven IRS Center ... PDF Draft 2021 Form 760-PMT, Payment Coupon - Virginia Tax COMPLETE THE PAYMENT COUPON BY INCLUDING THE FOLLOWING INFORMATION: Your Social Security Number (SSN) and Spouse's SSN (if filing a joint return). This must match the information on your return. Your name and spouse's name (if filing a joint return), address, and phone number. The amount of the enclosed payment.

2022 IL-501 Payment Coupon - Withholding (Payroll) Tax Forms Paying online is quick and easy! Click here to pay your IL-501 online. Click here to download the PDF payment coupon. Tax Forms. Business Registration Forms. Cannabis Forms. Excise Tax Forms. Income Tax Forms. Miscellaneous Tax Forms.

Payment coupon for irs

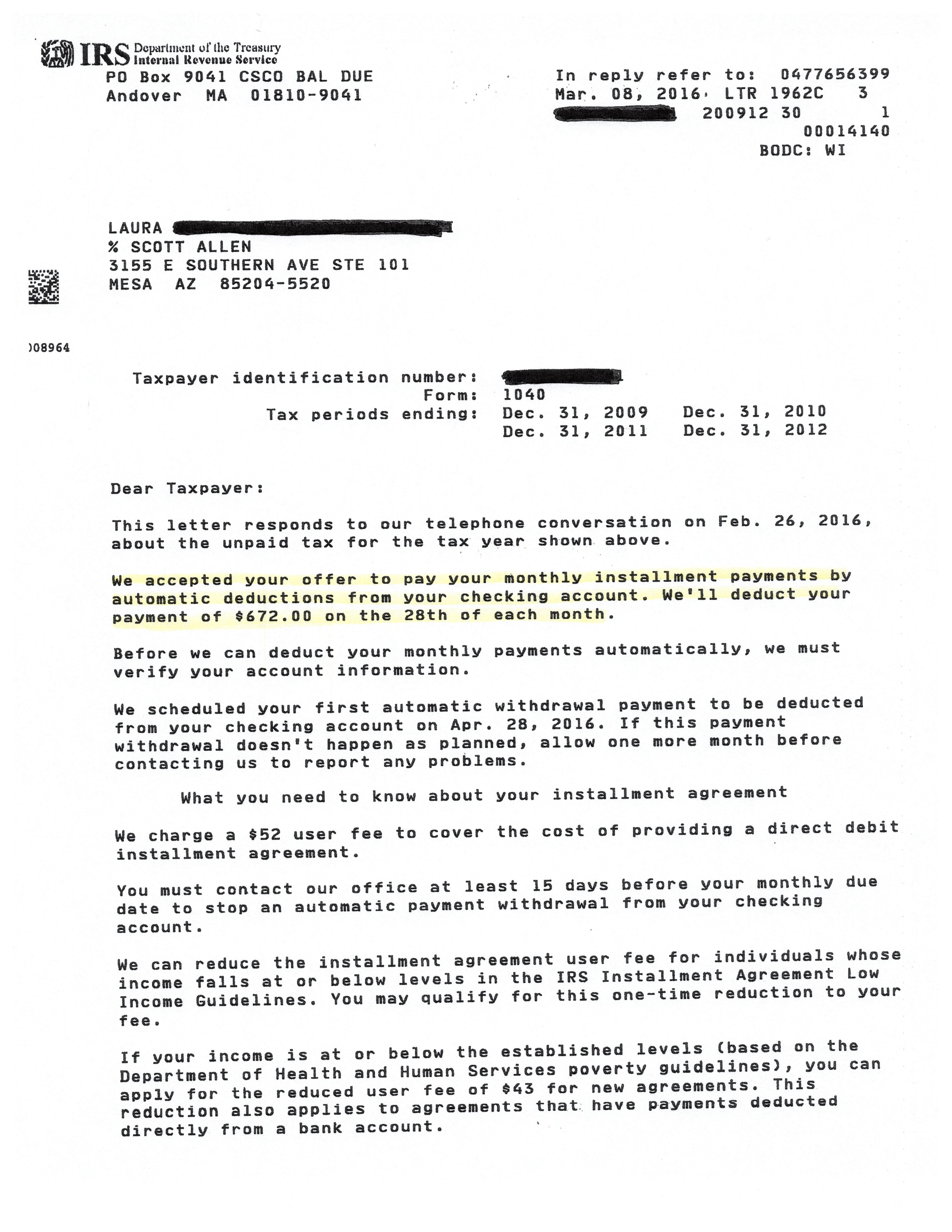

PDF 2021 Form 1040-V - IRS tax forms Detach Here and Mail With Your Payment and Return Form 1040-V Department of the Treasury Internal Revenue Service (99) Payment Voucher Do not staple or attach this voucher to your payment or return. Go to for payment options and information. OMB No. 1545-0074 2020 Print or type 1 Your social security number (SSN) IRS Payment Options With a 1040-V Payment Voucher As of the 2020 tax year, it ranges from $31 to $225, depending on how you make your payment. There are options and reduced fees available to low-income taxpayers who qualify. This is a one-time fee that's paid upfront. It is often part of your first payment. 4 You can apply for an installment agreement on the IRS website if you owe $50,000 or less. Payment Vouchers | Arizona Department of Revenue - AZDOR Arizona Individual Income Tax payment Voucher for Electronic Filing (This form has no separate instructions) Payment Vouchers. MET-1V. Arizona Marijuana Excise Tax Return Efile Return Payment Voucher. Payment Vouchers. TPT-V. Arizona Transaction Privilege Tax Efile Return Payment Voucher. Small Business Income Forms. AZ-140V-SBI.

Payment coupon for irs. PDF 2022 IL-501, Payment Coupon and Instructions - Illinois NOTE: Do not mail Form IL-501 if you electronically pay or are reporting a zero amount. Illinois Department of Revenue Payment Coupon IL-501 more information. Do not make a payment or submit an IL-501 Payment Coupon if no Illinois income tax was withheld. When is income tax considered withheld? In Illinois, income tax is considered withheld Payment Vouchers - Michigan Payment Vouchers Taxes Business Taxes Michigan Treasury Online Payment Vouchers Below are the vouchers to remit your Sales, Use and Withholding tax payment (s): 2021 Payment Voucher 2020 Payment Voucher 2019 Payment Voucher 2018 Payment Voucher 2017 Payment Voucher 2016 Payment Voucher 2015 Payment Voucher Payments | Internal Revenue Service For individuals only. View the amount you owe, your payment plan details, payment history, and any scheduled or pending payments. Make a same day payment from your bank account for your balance, payment plan, estimated tax, or other types of payments. Go to Your Account. 7 Ways To Send Payments to the IRS If You Need an Extension of Time to File . Some taxpayers might find that they can't make the tax filing date. You can typically take an extension by filing Form 4868 with the IRS (instead of a tax return) by the tax filing deadline, giving you until October 18, 2022, to submit your return. But any payment you owe is still due by the original tax due date, which is April 18 in 2022 for 2021 ...

Where can I find a payment voucher to print and send in for a tax owed? You can get a copy of your federal & state tax return (and all of their accompanying forms, worksheets, payment vouchers, etc.) by following the directions below. The state return should be at the bottom of the federal PDF file. For those who make estimated federal tax payments, the first quarter ... IR-2022-77, April 6, 2022 WASHINGTON — The Internal Revenue Service today reminds those who make estimated tax payments such as self-employed individuals, retirees, investors, businesses, corporations and others that the payment for the first quarter of 2022 is due Monday, April 18. IRS payment options | Internal Revenue Service 2019 Tax Liability - If paying a 2019 income tax liability without an accompanying 2019 tax return, taxpayers paying by check, money order or cashier's check should include Form 1040-V, Payment Voucher with the payment. Mail the payment to the correct address by state or by form. Do not send cash through the mail. About Form 1040-V, Payment Voucher | Internal Revenue Service About Form 1040-V, Payment Voucher Form 1040-V is a statement you send with your check or money order for any balance due on the "Amount you owe" line of your Form 1040 or 1040-NR. Current Revision Form 1040-V PDF Recent Developments None at this time. Other Items You May Find Useful All Form 1040-V Revisions Paying Your Taxes

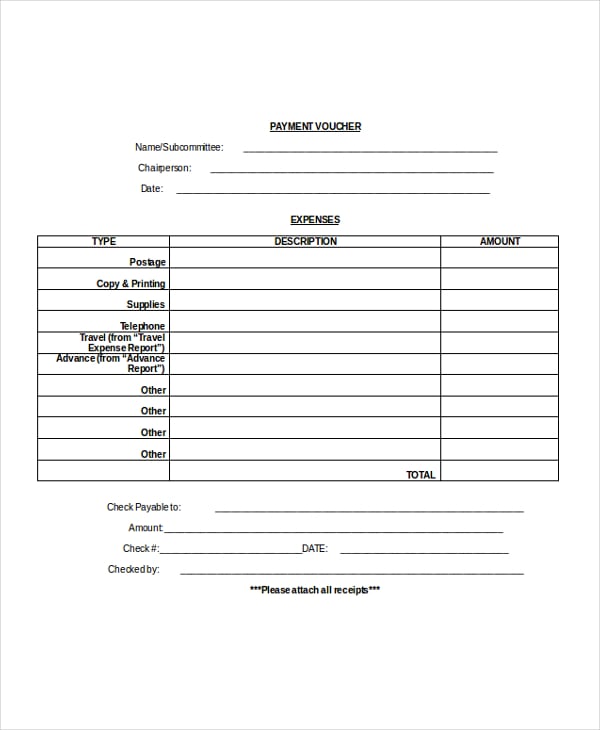

PDF Sample Tax Payment Coupon - Michigan Sample Tax Payment Coupon - Michigan Form 1040-V: Payment Voucher Definition - Investopedia Form 1040-V: Payment Voucher is a statement that taxpayers send to the Internal Revenue Service (IRS) along with their tax return if they choose to make a payment with a check or money order. 1 The... PDF 2020 Form 1040-V - IRS tax forms Internal Revenue Service. What Is Form 1040-V . It's a statement you send with your check or money order for any balance due on the "Amount you owe" line of your 2020 Form 1040, 1040-SR, or 1040-NR. Consider Making Your Tax Payment Electronically—It's Easy. You can make electronic payments online, by phone, or from a mobile device. How do I get Form 1040-V? - Intuit Form 1040-V (Payment Voucher) is an optional form that you can include with your check payment if you owe the IRS at the time of filing. If you're paper-filing and are paying via check, we'll include the 1040-V with your tax return printout, along with mailing instructions.

PDF 2021 Form 770-PMT, Payment Coupon - Virginia Tax For additional information visit or call (804) 367-8031. VIRGINIA DEPARTMENT OF TAXATION FORM 770-PMT - 2021 PAYMENT COUPON Va. Dept. of Taxation 770PMT 2601052 Rev. 06/21 Tax.00 Penalty.00 Interest.00 Amount of Payment.00 Payment Type 770 Return Payment 765 Return Payment Name of Estate, Trust or Pass-Through Entity

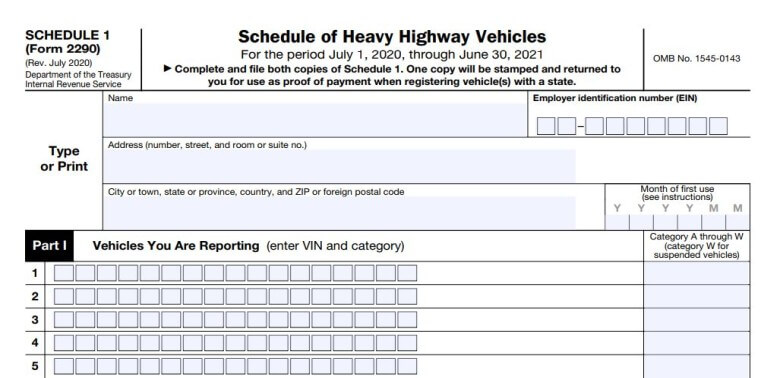

Generating estimated tax vouchers for an 1120 Corporation Forms 8109 and 8109-B, Federal Tax Coupon, can no longer be used to make federal tax deposits. Generally, electronic funds transfers are made using the Electronic Federal Tax Payment System (EFTPS). However, if the corporation does not want to use EFTPS, it can arrange for its tax professional, financial institution, payroll service, or other ...

PDF 2021 Payment Coupon (IL-501) and Instructions - Illinois mail Form IL-501 if you electronically pay or are reporting a zero amount. Illinois Department of Revenue. Payment Coupon. IL-501. more information. Do not . make a payment or submit an IL-501 Payment Coupon if no Illinois income tax was withheld. When is income tax considered withheld? In Illinois, income tax is considered withheld

Tax Deals & Coupons for 2022 Tax Preparation Code $7 Off State Filings 1 use today Code 20% Off Your Order 1 use today Sale 20% Off Your Online Federal Tax Filing 1 use today Sale For Limited Time! 3 Months Free Payroll 1 use today Code 5% Off Sitewide 2 uses today Sale Free Federal Prior Year Tax Filing + $17.99 State 1 use today Code 30% Off Orders 1 use today Code Up to $15 Off Your Order

What do I do with the Payment Voucher? - Intuit New Member. June 5, 2019 3:46 PM. Form 1040-V: Payment Voucher (not to be confused with 1040-ES: Estimated Tax Voucher) is an optional IRS form that you include with your check or money order when you mail your tax payment. Although the IRS will gladly accept your payment without the 1040-V, including it enables the IRS to process your payment ...

IRS Mailing Address: Where to Mail IRS Payments File For people who owe money on their tax balance, one way of making the payment is by mailing a money order or check to the IRS. The IRS may send you a notice stating your balance and where to send the payment, or you can use the payment voucher, which is Form 1040-V to pay the amount that is due on your Form 1040, 1040A, or 1040EZ.

Printable 2021 Federal Form 1040-V (Payment Voucher) File Now with TurboTax. We last updated Federal Form 1040-V in January 2022 from the Federal Internal Revenue Service. This form is for income earned in tax year 2021, with tax returns due in April 2022. We will update this page with a new version of the form for 2023 as soon as it is made available by the Federal government.

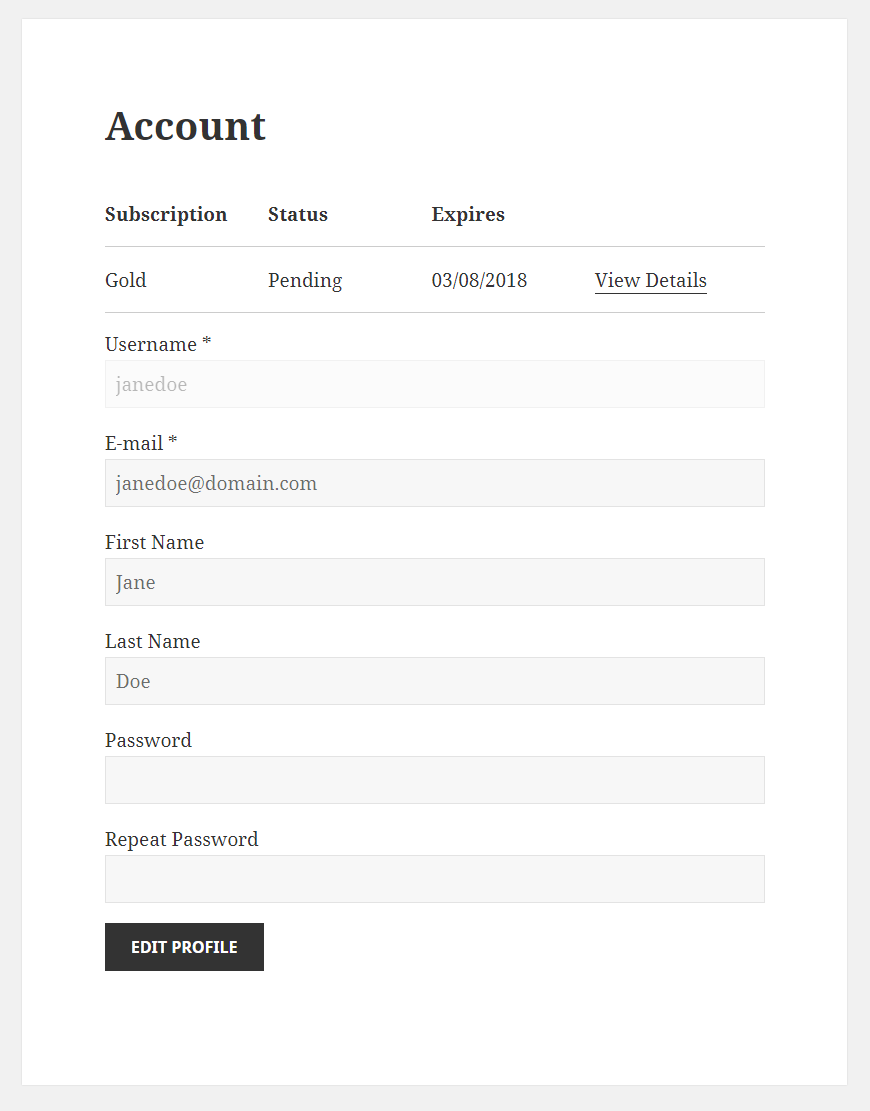

How to Print Form 1040-V, Payment Voucher - TaxAct How to Print Form 1040-V, Payment Voucher To print IRS Form 1040-V, Payment Voucher: Sign in to your TaxAct account Click the My Taxes tile at the bottom of the page Click the Open link to the right of the return you wish to open Click Print Center Click Custom Check the box for Federal Form 1040-V - Your Name Scroll down and click the Print button

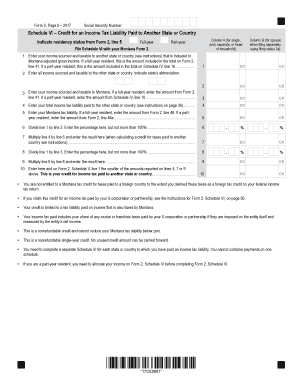

Payment Coupon Templates - 11+ Free Printable PDF Documents Download Payment Coupon Templates - 11+ Free Printable PDF Documents Download A payment coupon template was designed to help you help customers make payments at the counter in a personalized way. The coupon template is only used at an instance where you want your customers to purchase available items at discount prices.

Payment Vouchers | Arizona Department of Revenue - AZDOR Arizona Individual Income Tax payment Voucher for Electronic Filing (This form has no separate instructions) Payment Vouchers. MET-1V. Arizona Marijuana Excise Tax Return Efile Return Payment Voucher. Payment Vouchers. TPT-V. Arizona Transaction Privilege Tax Efile Return Payment Voucher. Small Business Income Forms. AZ-140V-SBI.

IRS Payment Options With a 1040-V Payment Voucher As of the 2020 tax year, it ranges from $31 to $225, depending on how you make your payment. There are options and reduced fees available to low-income taxpayers who qualify. This is a one-time fee that's paid upfront. It is often part of your first payment. 4 You can apply for an installment agreement on the IRS website if you owe $50,000 or less.

PDF 2021 Form 1040-V - IRS tax forms Detach Here and Mail With Your Payment and Return Form 1040-V Department of the Treasury Internal Revenue Service (99) Payment Voucher Do not staple or attach this voucher to your payment or return. Go to for payment options and information. OMB No. 1545-0074 2020 Print or type 1 Your social security number (SSN)

Post a Comment for "43 payment coupon for irs"