39 zero coupon convertible bond

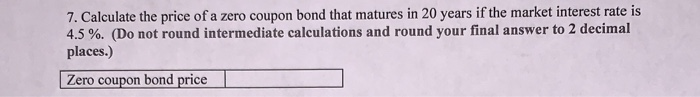

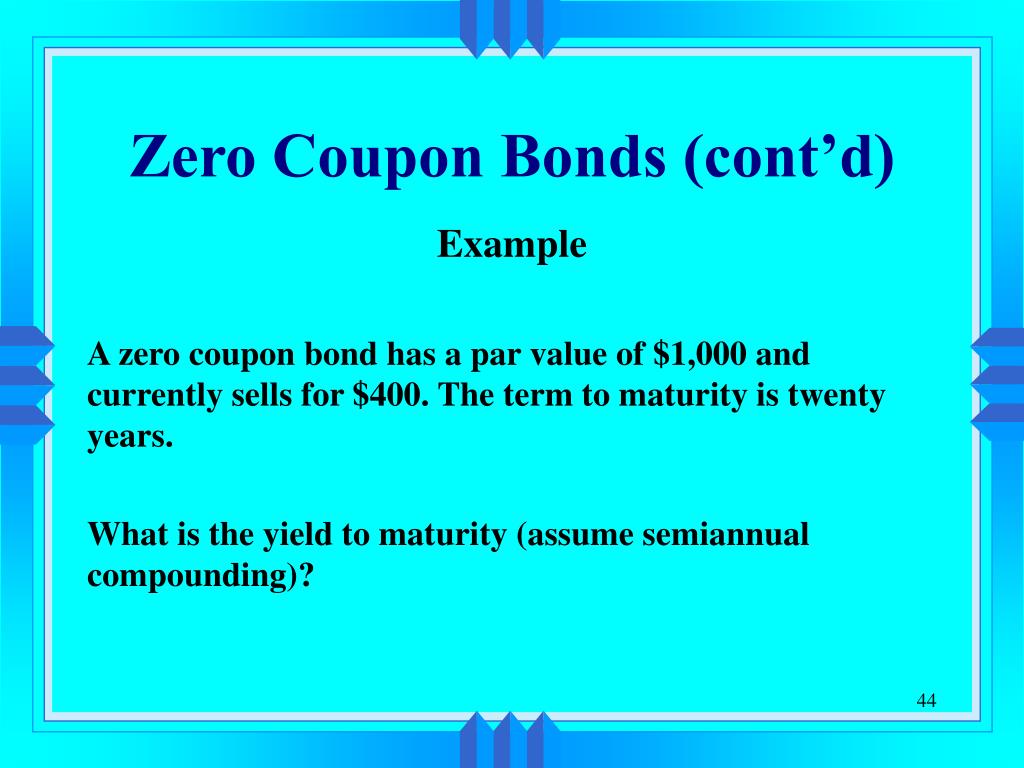

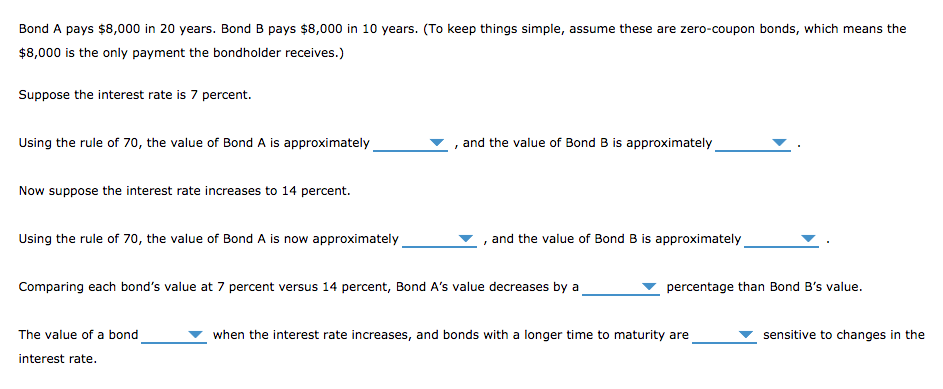

Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. Zero-coupon bond - Bogleheads Zero-coupon bonds or "zeros" result from the separation of coupons from the body of a security. Consequently, from a single coupon-paying bond, two bonds result: one which pays the coupons but returns no principal at maturity (an annuity), and one which pays no coupons but returns the par value at maturity (a zero-coupon bond). Zeroes sell ...

Zero-Coupon Convertible Due to the zero - coupon feature, the bond pays no interest and is issued at a discount to par value, while the convertible feature means that the bond is convertible into common stock of the issuer at a certain conversion price. The zero - coupon and convertible features offset each other in terms of the yield required by investors.

Zero coupon convertible bond

Journal Entry for Zero Coupon Bonds | Accounting Education Zero coupon bonds are the famous type of bonds in which the company will gives only face value without paying any extra discount. Investor gets earning buy getting the zero coupon bonds at discount. This discount will be the income of investor and second side, company has to show it as interest which not in cash but it is Day count convention - Wikipedia In finance, a day count convention determines how interest accrues over time for a variety of investments, including bonds, notes, loans, mortgages, medium-term notes, swaps, and forward rate agreements (FRAs). This determines the number of days between two coupon payments, thus calculating the amount transferred on payment dates and also the accrued interest for … Notice Concerning Converted Price Adjustment of Zero Coupon Convertible ... We hereby provide notice of the adjustment to the Conversion Price of Zero Coupon Convertible Bonds due 2023 issued by Sumitomo Metal Mining Co.,Ltd. as follows: Please check the below PDF file for details. Notice Concerning Converted Price Adjustment of Zero Coupon Convertible Bonds Due 2023. Back to list.

Zero coupon convertible bond. Zero-Coupon Bond: Formula and Excel Calculator - Wall Street Prep Zero-Coupon Bond Features Zero-coupon bonds, also known as "discount bonds," are sold by the issuer at a price lower than the face (par) value that is repaid at maturity. If Price > 100 "Premium" (Trading Above Par) If Price = 100 "Par" (Trading at Par Value) If Price < 100 "Discount" (Trading Below Par) Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. ANA : Announcement on Issuance of Zero Coupon Convertible Bonds due ... ANA HOLDINGS INC. (the "Company") hereby announces that, at its board of directors' meeting held on 24 November 2021, the Company resolved to issue Zero Coupon Convertible Bonds due 2031 (the "Bonds") (the Bonds with stock acquisition rights, tenkanshasaigata shinkabu yoyakuken- tsuki shasai ). [Background of the Issuance of the Bonds] Record Run for Zero-Interest Convertible Bonds Hits a Wall Investors gobbled up convertible bonds with zero coupon from companies including Airbnb, SoFi, Snap, Ford, DraftKings, Twitter, Shake Shack, Spotify and Dish Network. They were essentially lending...

Compulsory Convertible Debenture (CCD) Definition 26.08.2020 · Compulsory Convertible Debenture - CCD: A type of debenture in which the whole value of the debenture must be converted into equity by a specified time. The compulsory convertible debenture's ... Zero-Coupon Bond - Definition, How It Works, Formula As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future – an investor would prefer to receive $100 today than $100 in one year. By r... Dirty price - Wikipedia When bond prices are quoted on a Bloomberg Terminal, Reuters or FactSet they are quoted using the clean price. Bond pricing. Bonds, as well as a variety of other fixed income securities, provide for coupon payments to be made to bond holders on a fixed schedule. The dirty price of a bond will decrease on the days coupons are paid, resulting in a saw-tooth pattern for the … Convertible Bonds Explained (2022): Everything You Need to Know In fact, convertible bonds were so popular that companies were even able to offer a zero coupon convertible bond and still have buyers! Let's dig into a hypothetical convertible bond offered by a technology company. In May 2021, Tech Corp offered a vanilla convertible bond with a par value of $1,000. Because the market for convertibles was in ...

Bond Yield to Maturity Calculator for Comparing Bonds So, if you hold a convertible bond with a par value of $1000, and it is exchangeable for 50 shares in the company, you might consider converting it into stock when prices rise above $20 per share. Convertible bonds do offer an added opportunity to increase the return on your investment, but changing your investment from a security to a stock comes with substantially … Zero-Coupon Convertible - Investopedia A zero-coupon convertible is a convertible bond issued by a corporation that pays no regular interest to bondholders. Because of the zero-coupon feature, these convertibles are sold at a discount... Zero Coupon Convertible Bond - Financial Dictionary Zero-Coupon Convertible Bond 1. A bond that may be converted into common stock in the company issuing it. A zero-coupon convertible bond is sold at a discount from par and matures at par. They tend to be volatile in the secondary market because the convertible option may or may not become worthwhile, depending on how the company is performing ... Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. That definition assumes a positive time value of money.It does not make periodic interest payments or have so-called coupons, hence the term zero coupon bond.When the bond reaches maturity, its investor receives its par (or face) value.

Zero-Coupon Bonds: Pros and Cons - Management Study Guide Zero-coupon bonds are those bonds that are sold at a deep discount to their face value. This means that these bonds do not receive any periodic interest. Instead, the investors have to invest a lump sum amount at the beginning of their investment and get paid a higher lumpsum amount at the end of their investment.

Zero coupon convertibles do not have a zero cost Zero coupon convertibles do not have a zero cost Published 11 May 2021 Convertible bond issuance is at a record high, with companies 'benefiting' from low interest rates and high equity volatility. A recent $1.44bn convertible bond issue by Twitter, with a zero coupon and conversion premium of 67%, is a good example.

The One-Minute Guide to Zero Coupon Bonds | FINRA.org zero-coupon bond on the secondary market will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000.

What is the difference between a zero-coupon bond and a regular bond? Zero-coupon bonds may also appeal to investors looking to pass on wealth to their heirs. If a bond selling for $2,000 is received as a gift, it only uses $2,000 of the yearly gift tax exclusion....

Zero Coupon Convertible.docx - What Is a Zero-Coupon... A zero-coupon convertible is, consequently, a non-interest paying bond that can be changed over into the value of the responsible organization after the stock arrives at a specific cost. A financial backer who buys this kind of safety pays a rebate for prior any interest pay.

14.3 Accounting for Zero-Coupon Bonds - Financial Accounting A zero-coupon bond is one that is popular because of its ease. The face value of a zero-coupon bond is paid to the investor after a specified period of time but no other cash payment is made. There is no stated cash interest. Money is received when the bond is issued and money is paid at the end of the term but no other payments are ever made.

Zero Coupon Convertible Debenture Law and Legal Definition Zero Coupon Convertible Debenture/security is a zero coupon bond that is convertible into the common stock of the issuing company after the common stock reaches a certain price. A zero-coupon bond (also called a discount bond or deep discount bond) is a bond bought at a price lower than its face value.

Record Run for Zero-Interest Convertible Bonds Hits a Wall Before 2020, a zero-coupon convertible bond was a rarity. Between 2009 and 2019, only 18 companies issued convertible notes that didn't pay any interest, according to JPMorgan data. In 2020, there were 22 such offerings. In 2021, there were 45. Among those: In March 2021, DraftKings raised nearly $1.3 billion with a zero-coupon convertible.

Zero-Coupon Bond Definition - Investopedia 11.11.2021 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

Zero Coupon Bonds- Taxability under Income Tax Act, 1961 Under Income Tax Act, 1961, Income derived from gain on sale of shares, debentures, bonds etc. attracts taxability under the head of "Capital Gains". Such gain is either taxable as short term capital gain or long term capital gain. In this article, we will discuss the concept of "Zero Coupon Bonds" and throw light on taxing aspects of ...

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest

Why the zero coupon bond market is booming - afr.com Twitter, Airbnb, Dropbox, Beyond Meat and Ford have all issued zero coupon bonds with conversion prices of between 40 and 70 per cent above the share price within the past six weeks. Delta hedging...

Record run for zero-rate convertible bonds hits a wall - OLTNEWS Prior to 2020, a zero-coupon convertible bond was a rarity. Between 2009 and 2019, only 18 companies issued convertible bonds that paid no interest, according to JPMorgan data. In 2020, there were 22 such offers. In 2021, there were 45. Among them: In March 2021, DraftKings raised nearly $1.3 billion with a zero-coupon convertible.

MicroStrategy Completes $1.05 Billion Offering of Convertible Notes at ... MicroStrategy Completes $1.05 Billion Offering of Convertible Notes at 0% Coupon and 50% Conversion Premium with Bitcoin Use of Funds MicroStrategy Completes $1.05 Billion Offering of Convertible Notes at 0% Coupon and 50% Conversion Premium with Bitcoin Use of Funds Press Release | February 19, 2021 PDF Version

Zero-coupon convertible bond - TheFreeDictionary.com Zero-Coupon Convertible Bond 1. A bond that may be converted into common stock in the company issuing it. A zero-coupon convertible bond is sold at a discount from par and matures at par. They tend to be volatile in the secondary market because the convertible option may or may not become worthwhile, depending on how the company is performing.

Chapter 6 -- Interest Rates Zero coupon bonds: no interest payments (coupon rate is zero) Junk bonds: high risk, high yield bonds Eurobonds: bonds issued outside the U.S. but pay interest and principal in U.S. dollars International bonds Characteristics of bonds Claim on assets and income Par value (face value, M): the amount that is returned to the bondholder at maturity, usually it is $1,000 Maturity date: …

Notice Concerning Converted Price Adjustment of Zero Coupon Convertible ... We hereby provide notice of the adjustment to the Conversion Price of Zero Coupon Convertible Bonds due 2023 issued by Sumitomo Metal Mining Co.,Ltd. as follows: Please check the below PDF file for details. Notice Concerning Converted Price Adjustment of Zero Coupon Convertible Bonds Due 2023. Back to list.

Post a Comment for "39 zero coupon convertible bond"