44 coupon rate and ytm

Coupon Rate - Meaning, Calculation and Importance - Scripbox The main distinction between the coupon rate and YTM is the return estimation. The coupon rate payments are the same for the bond tenure. While the yield on maturity varies depending on various factors such as the number of years till maturity and the current trading price of the bond. Let's assume the couponrate for a bond is 15%. Coupon vs Yield | Top 5 Differences (with Infographics) The way the coupon rate is calculated is by dividing the annual coupon payment by the face value of the bond. In this case, the coupon rate for the bond will be $40/$1000, which is a 4% annual rate. It can be paid quarterly, semi-annually, or yearly depending on the bond.

What is the relationship between YTM and the discount rate of a bond? Answer (1 of 3): They can be considered part of the same thing and depends on the type of bond. Yield to maturity is a concept for fixed rate bonds and is the internal rate of return i.e. the rate at which future flows are discounted on a compound basis to give the present value of the bond incl...

Coupon rate and ytm

When is a bond's coupon rate and yield to maturity the same? The coupon rate is often different from the yield. A bond's yield is more accurately thought of as the effective rate of return based on the actual market value of the bond. At face value, the... Yield to Maturity Calculator | Good Calculators C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity. Example 2: Suppose a bond is selling for $980, and has an annual coupon rate of 6%. It matures in five years, and the face value is $1000. What is the Yield to Maturity? Understanding the Yield to Maturity (YTM) Formula | SoFi The YTM is stated as an annual rate and can differ from the stated coupon rate. The calculations in the yield to maturity formula include the following factors: • Coupon rate: Also known as a bond's interest rate, the coupon rate is the regular payment issuers pay bondholders for the right to borrow their money. The higher the coupon rate ...

Coupon rate and ytm. Yield to Maturity vs. Coupon Rate: What's the Difference? To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for... Calculating Cost of Debt: YTM and Debt-Rating Approach The yield to maturity is the annual return from an investment purchased today and held till maturity, i.e., it is the rate at which the current market price of the bond is equal to the present value of all the cash flows from the bond. ... Coupon: 8%: Coupon payment: Semi-annual: Maturity: 10 year: The YTM will be the rate at which the present ... Yield to maturity calculator The current yield is the coupon rate or interest divided by the current price. If the bond paying $600 per year costs $10,500, the current yield is 5.71 percent. The yield to maturity amortizes a premium or discount over the remaining life of the bond. Yield to Maturity (YTM): Formula and Excel Calculator An important distinction between a bond's YTM and its coupon rate is the YTM fluctuates over time based on the prevailing interest rate environment, whereas the coupon rate is fixed. Yield to Maturity (YTM) and Coupon Rate / Current Yield If the YTM < Coupon Rate and Current Yield → The bond is being sold at a "premium" to its par value.

Yield to Maturity Calculator | Calculate YTM coupon rate is the annual interest you will receive by investing in the bond, and frequency is the number of times you will receive it in a year. In the yield to maturity calculator, you can choose from six different frequencies, from annually to daily. In our example, Bond A has a coupon rate of 5% and an annual frequency. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions. Yield to Maturity (YTM) - Definition, Formula, Calculations Solution: Use the below-given data for calculation of YTM. We can use the above formula to calculate approximate yield to maturity. Coupons on the bond will be $1,000 * 8%, which is $80. Yield to Maturity (Approx) = (80 + (1000 - 94) / 12 ) / ( (1000 + 940) / 2) YTM will be -. Coupon Rate Yield To Maturity - bizimkonak.com Yield to Maturity (YTM) - Overview, Formula, and … CODES (8 days ago) On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years.

Understanding Coupon Rate and Yield to Maturity of Bonds Let's see what happens to your bond when interest rates in the market move. When bonds are initially issued in the primary market, the Coupon Rate is based on current market rates, hence YTM is equal to the coupon rate. In the example bond above, when you bought the 3-year RTB issued at the primary market, your YTM and coupon rate is 2.375%. Yield to Maturity vs Coupon Rate: What's the Difference The YTM considers market changes because, even though your bond's interest rate will not change, its value will fluctuate depending on the market's rates. You need to know the coupon rate, the price of the bond, its value, and the maturity date to calculate the YTM. If you purchase the bond at face value, the YTM and the coupon rate are the ... Difference between YTM and Coupon Rates A YTM, or yield-to-maturity, reflects the annual return an investor would receive if they held a bond until it matures. A coupon rate is the percentage of the face value of a bond that is paid out as interest to investors on a yearly basis. The higher the coupon rate, the more money investors will earn on their investment. What's the difference b/w coupon rate and YTM? And why do we ... - reddit In this example, since the ytm is less than the coupon rate, the bond must be trading at a premium to its face value. Let's say with a FV of 100, you end up paying 102. Now 5.8% will be the discount rate used to bring back the $6 annual coupon payments and $100 principal repayment back to the present value. Coupon rate is exactly what it says.

Difference Between YTM and Coupon rates 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2. YTM includes the coupon rate in its calculation. Author Recent Posts Ian Search DifferenceBetween.net : Help us improve.

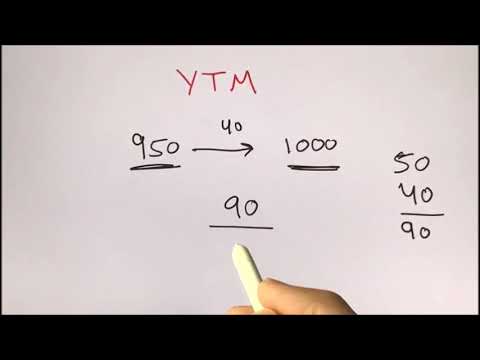

Yield to Maturity (YTM) - Meaning, Formula & Calculation Since the bond is selling at a discount, the interest rate or YTM will be higher than the coupon rate. Using the YTM formula, the required yield to maturity can be determined. INR 950 = 40/ (1+YTM)^1 + 40/ (1+YTM)^2 + 40/ (1+YTM)^3+ 1000/ (1+YTM)^3 We can try out the interest rate of 5% and 6%.

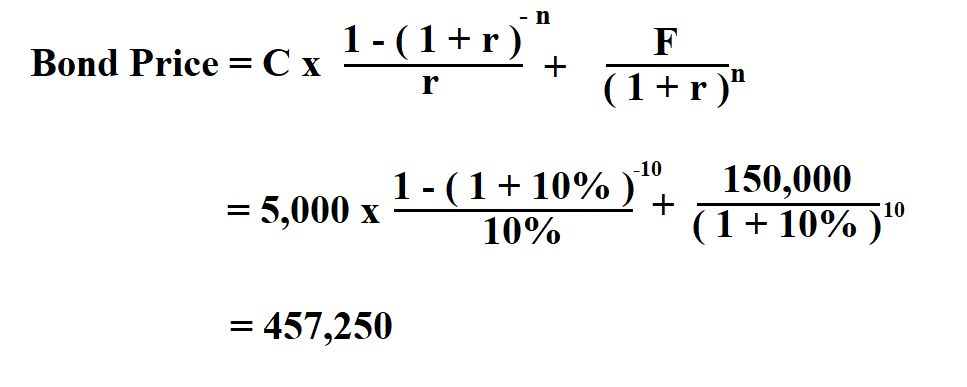

Yield to Maturity (YTM) - Overview, Formula, and Importance On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity

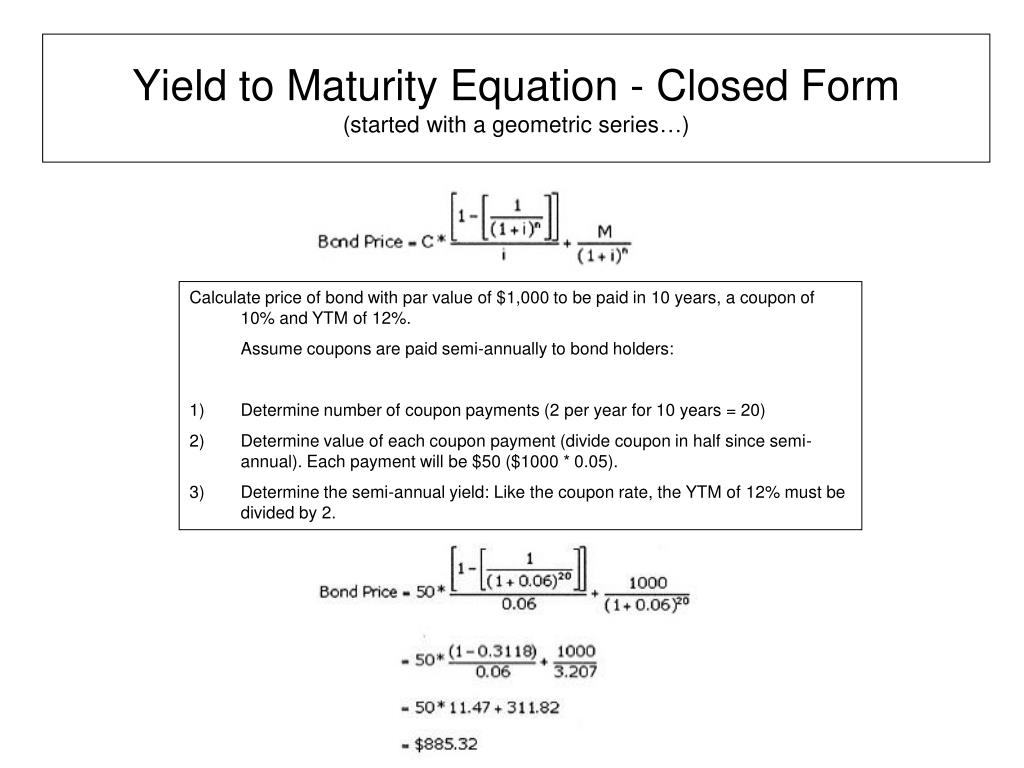

Bond Yield to Maturity (YTM) Calculator - DQYDJ We calculated the rate an investor would earn reinvesting every coupon payment at the current rate, then determining the present value of those cash flows. The summation looks like this: Price = Coupon Payment / ( 1 + rate) ^ 1 + Coupon Payment / ( 1 + rate) ^ 2 ... + Final Coupon Payment + Face Value / ( 1 + rate) ^ n

Difference Between Coupon Rate and Yield to Maturity The main difference between Coupon Rate and Yield to Maturity (YTM) is that Coupon Rate is the fixed sum of money that a person has to pay at face value. In contrast, Yield to Maturity (YTM) is the amount a person will retrieve after the maturation of their bonds. The Coupon Rate is said to be the same throughout the bond tenure year.

Yield to Maturity (YTM) - Meaning, Formula and Examples The coupon rate is more or less fixed. How do YTMs work? The price at which the bond can be bought from the market will tell you the present value of all the cash flows in the future. But, bonds are marketable securities, and the prices fluctuate with moving interest rates in the economy. Now, here's the catch.

Important Differences Between Coupon and Yield to Maturity Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate.

Bond \( X \) is a premium bond making semiannual | Chegg.com The bond has a coupon rate of 8.2 percent, a YTM of 6.2 percent, and has 15 years to maturity. Bond Y is a discount bond making semiannual payments. This bond has a coupon rate of 6.2 percent, a YTM of 8.2 percent, and also has 15 years to maturity. Assume the interest rates remain unchanged and both bonds have a par value of $1.000. o.

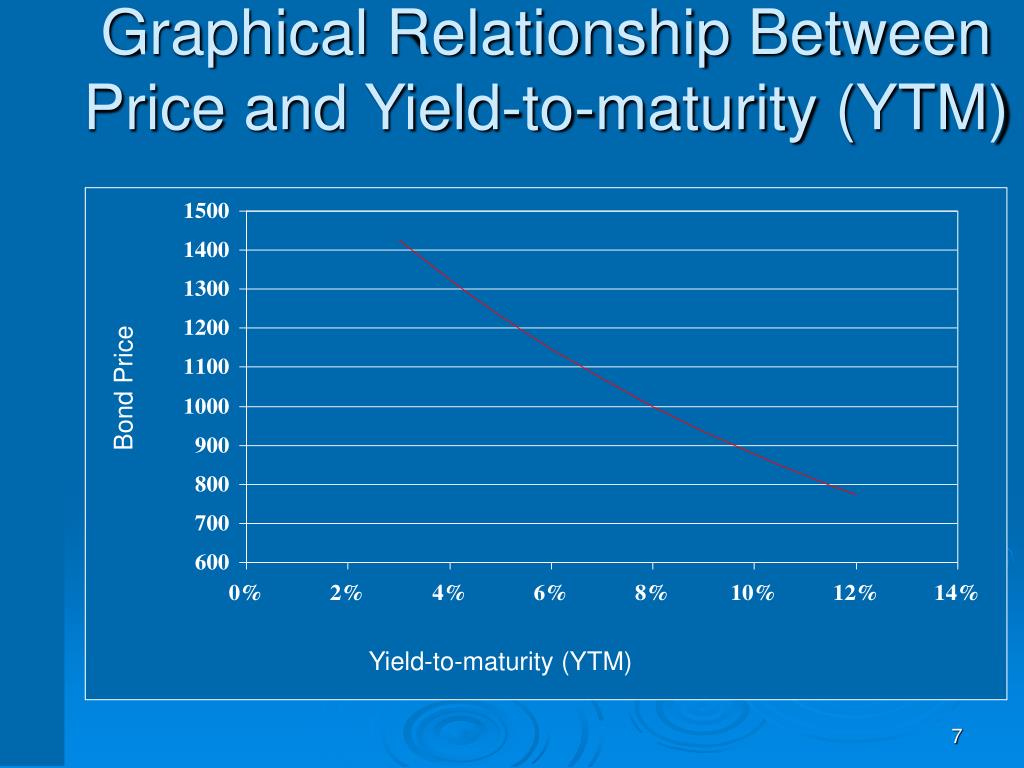

Concept 82: Relationships among a Bond's Price, Coupon Rate, Maturity ... The relationship between a bond's price and its YTM is convex. Percentage price change is more when discount rate goes down than when it goes up by the same amount. Relationship with coupon rate A bond is priced at a premium above par value when the coupon rate is greater than the market discount rate.

Difference Between Coupon Rate and Yield of Maturity The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Conclusion

Understanding the Yield to Maturity (YTM) Formula | SoFi The YTM is stated as an annual rate and can differ from the stated coupon rate. The calculations in the yield to maturity formula include the following factors: • Coupon rate: Also known as a bond's interest rate, the coupon rate is the regular payment issuers pay bondholders for the right to borrow their money. The higher the coupon rate ...

Yield to Maturity Calculator | Good Calculators C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity. Example 2: Suppose a bond is selling for $980, and has an annual coupon rate of 6%. It matures in five years, and the face value is $1000. What is the Yield to Maturity?

When is a bond's coupon rate and yield to maturity the same? The coupon rate is often different from the yield. A bond's yield is more accurately thought of as the effective rate of return based on the actual market value of the bond. At face value, the...

![[70% Off Discount] YTCockpit Coupon & Promo Code – Aoo Coupon Codes ...](https://www.aoocoupon.com/wp-content/uploads/2019/09/YTCockpit-Coupon.png)

Post a Comment for "44 coupon rate and ytm"