40 bond coupon interest rate

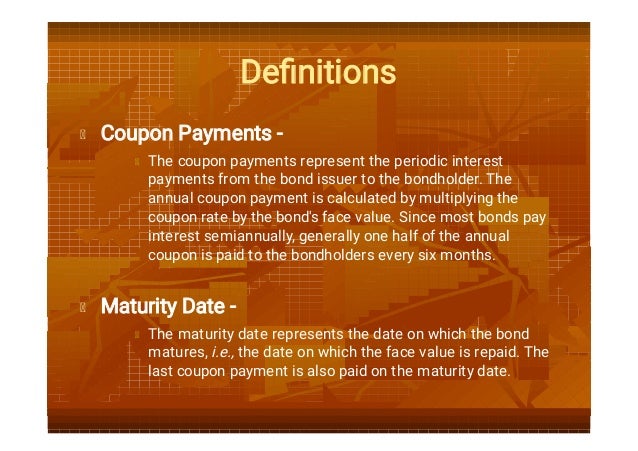

What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities. Basics Of Bonds - Maturity, Coupons And Yield - InCharge Debt Solutions Bond Coupon Payments. A bond's coupon is the annual interest rate paid on the issuer's borrowed money, generally paid out semi-annually on individual bonds. The coupon is always tied to a bond's face or par value and is quoted as a percentage of par. Say you invest $5,000 in a six-year bond paying a coupon rate of five percent per year ...

Series I Savings Bonds Rates & Terms: Calculating Interest Rates NEWS: The initial interest rate on new Series I savings bonds is 9.62 percent. You can buy I bonds at that rate through October 2022. Learn more. KEY FACTS: I Bonds can be purchased through October 2022 at the current rate. That rate is applied to the 6 months after the purchase is made. For example, if you buy an I bond on July 1, 2022, the 9. ...

Bond coupon interest rate

Difference Between Coupon Rate and Interest Rate The coupon rate is normally used in the bonds, which is an income to the holder after paying the rate on certain purchased items. Interest rate is a reduction to the borrower by paying back the amount he/she has borrowed. The coupon Rate ends according to the maturity period mentioned by the bondholder while issuing the bond. What Is Coupon Rate and How Do You Calculate It? - SmartAsset The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. In our example above, the $1,000 pays a 10% interest rate on its coupon. Investors use the phrase coupon rate for two reasons. Coupon Bond Formula | Examples with Excel Template - EDUCBA The term "coupon" refers to the periodic interest payment received by bondholders and bonds that make such payments are known as coupon bonds. Typically, the coupon is expressed as a percentage of the par value of the bond. ... the company had raised $50,000 by issuing 50,000 bonds worth $1,000 each. The bonds offer coupon rate of 5% to be ...

Bond coupon interest rate. Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment. Individual - Treasury Bonds: Rates & Terms The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions .) The price of a fixed rate security depends on its yield to maturity and the interest rate. Coupon Interest and Yield for eTBs | australiangovernmentbonds What is the Coupon Interest Rate? The Coupon Interest Rate on a Treasury Bond is set when the bond is first issued by the Australian Government, and remains fixed for the life of the bond. For example, a Treasury Bond with a 5% Coupon Interest Rate will pay investors $5 a year per $100 Face Value amount in instalments of $2.50 every six months. WHAT IS COUPON RATE OF A BOND - The Fixed Income A coupon rate, simply put, is the interest rate at which an investor will get fixed coupon payments paid by the bond issuer on an annual basis over the period of an investment. In other words, the coupon rate on a bond when first issued gets pegged to the prevailing interest rate, and remains constant over the duration of an investment.

What Is the Coupon Rate of a Bond? - The Balance 18.11.2021 · If prevailing interest rates on other similar bonds rise, pushing down the price of the bond in the secondary market, the amount of interest paid remains at the coupon rate based on the bond’s par value. The same will occur if interest rates drop, pushing the price of the bond higher in the secondary market. Relationship Between Interest Rates & Bond Prices - Investopedia 16.5.2022 · Conversely, if interest rates rise, investors will no longer prefer the lower fixed interest rate paid by a bond, resulting in a decline in its price. … Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond.. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value.For example, if a bond has a face value of $1,000 and a coupon rate of 5%, then it pays total ... What Is a Coupon Rate? - Investment Firms A coupon rate, also known as coupon payment, is the rate of interest paid by bond issuers on a bond's face value. Generally, a coupon rate is calculated by summing up the total number of coupons paid per year and dividing it by its bond face value. Take this 20 question survey to find a financial advisor Find the right advisor for you

What is 'Coupon Rate' - The Economic Times Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. Coupon Rate vs Interest Rate | Top 8 Best Differences ... - WallStreetMojo Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100%read moreis the rate of interest being paid off for the fixed income security such as bonds. This interest is paid by the bond issuers where it is being calculated annually on the bonds face value, and it is being paid to the purchasers. Bond derivatives - Australian Securities Exchange ASX's new 5 Year Treasury Bond Future bridges the gap between the 3 and 10 Year Bond Futures by providing an additional point on the curve. ASX ... Interest rate derivatives providing efficient exposure to the Australian debt markets. ... Coupon rate: 6% pa; Term: 3 years; Face value: ... Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo Also, the issuer’s creditworthiness drives the coupon rate of a bond, i.e., a company rated “B” or below by any of the top rating agencies is likely to offer a higher coupon rate than the prevailing market interest rate to counterbalance the additional credit risk Credit Risk Credit risk is the probability of a loss owing to the borrower's failure to repay the loan or meet debt obligations.

Coupon Rate Calculator | Bond Coupon 15.7.2022 · With this coupon rate calculator, we aim to help you to calculate the coupon rate of your bond investment based on the coupon payment of the bond.Coupons are one of your two main sources of income when investing in bonds. Thus, it is essential to understand this concept before you dabble in the bond investment world.. We have prepared this article to help you …

How Is the Interest Rate on a Treasury Bond Determined? 27.8.2022 · T-bonds don't carry an interest rate as a certificate of deposit (CDs) would. Instead, a set percent of the face value of the bond is paid out …

How to Calculate an Interest Payment on a Bond: 8 Steps 10.12.2021 · Multiply the bond's face value by the coupon interest rate. By multiplying the bond's face value by its coupon interest rate, you can figure out what the dollar amount of that interest rate is each year. For example, if the bond's face value is $1000, and the interest rate is 5%, by multiplying 5% by $1000, you can find out exactly how much ...

Bond Coupon Interest Rate: How It Affects Price - Investopedia A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage of the bond's...

Bond Prices, Rates, and Yields - Fidelity While you own the bond, the prevailing interest rate rises to 7% and then falls to 3%. 1. The prevailing interest rate is the same as the bond's coupon rate. The price of the bond is 100, meaning that buyers are willing to pay you the full $20,000 for your bond. 2. Prevailing interest rates rise to 7%.

Sovereign Gold Bond - Schemes, Price, Returns, Interest Rate 2020 28.4.2021 · However, one can also encash/ redeem the bond after 5th year from the date of issue on coupon payment dates. On maturity: The investor will be advised one month before maturity. On maturity, the gold bonds will be redeemed in Indian rupees based on the selling price published by the Indian Bullion and Jewelers Association Limited.

Zero Coupon Bond (Definition, Formula, Examples, Calculations) = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total …

Coupon Rate: Formula and Bond Nominal Yield Calculator [Excel Template] The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000

How Are Bond Prices Affected by Coupon Payment Dates? This Treasury bond has a 6% coupon and makes $30 interest payments every Feb. 15 and Aug. 15. You are buying the bond on the 122nd day of a payment period that has 184 days.

Why Do Bond Prices Go Down When Interest Rates Rise? - The … 16.2.2022 · The bond has a 3% coupon (or interest payment) rate, which means that it pays you $30 per year. If you’re paid every six months, you’ll receive $15 in coupon payments. Suppose you want to sell your bond one year later, but the market interest rate has increased to 4%.

Bonds and Interest Rates | FINRA.org Say you bought a $1,000 bond with a 6 percent coupon a few years ago and decided to sell it three years later to pay for a trip to visit your ailing grandfather, except now, interest rates are at 4 percent. This bond is now quite attractive compared to other bonds out there, and you would be able to sell it at a premium. Basis Point Basics

Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000...

Bond Price Calculator | Formula | Chart To calculate the coupon per period you will need two inputs, namely the coupon rate and frequency. It can be calculated using the following formula: coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50.

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing For example, if the face value of a bond is $1,000 and its coupon rate is 2%, the interest income equals $20. Whether the economy improves, worsens, or remains the same, the interest income does not change. Assuming that the price of the bond increases to $1,500, then the yield-to-maturity changes from 2% to 1.33% ($20/$1,500= 1.33%).

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100. Coupon Rate = (20 / 100) * 100. Coupon Rate = 20%. Now, if the market rate of interest is lower than 20% than the bond will be traded at a premium as this bond gives more value to the investors compared to other fixed income securities.

Bond Price Calculator Let's assume that someone holds for a period of 10 years a bond with a face value of $100,000, with a coupon rate of 7% compounded semi-annually, while similar bonds on the market offer a rate of return of 6.5%. Let's figure out its correct price in case the holder would like to sell it: Bond price = $103,634.84

Coupon Bond Formula | Examples with Excel Template - EDUCBA The term "coupon" refers to the periodic interest payment received by bondholders and bonds that make such payments are known as coupon bonds. Typically, the coupon is expressed as a percentage of the par value of the bond. ... the company had raised $50,000 by issuing 50,000 bonds worth $1,000 each. The bonds offer coupon rate of 5% to be ...

Post a Comment for "40 bond coupon interest rate"