40 coupon rate semi annual

How to Calculate Semi-Annual Bond Yield | The Motley Fool Its coupon rate is 2% and it matures five years from now. To calculate the semi-annual bond payment, take 2% of the par value of $1,000, or $20, and divide it by two. The bond therefore pays $10... What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

Semiannual coupon and annual coupon | Forum | Bionic Turtle So the rate is 5% per semiannual period which is used to pay coupon at end of each half year. so that for a bond with face value 100 with 10% semiannual couponsmeans that coupons are paid semiannually (at end of each half year) at 10/2%=5% which is (5/100)*100=5 , so the semiannual coupon is 5% because the rate 10% is compounded semiannually.

Coupon rate semi annual

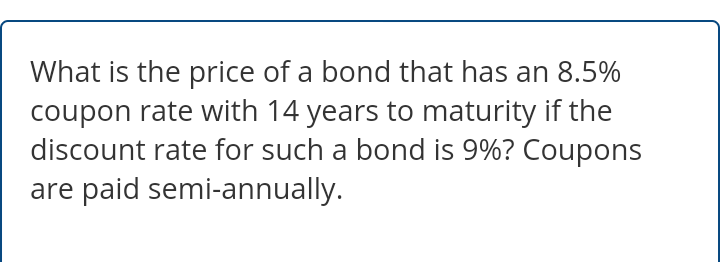

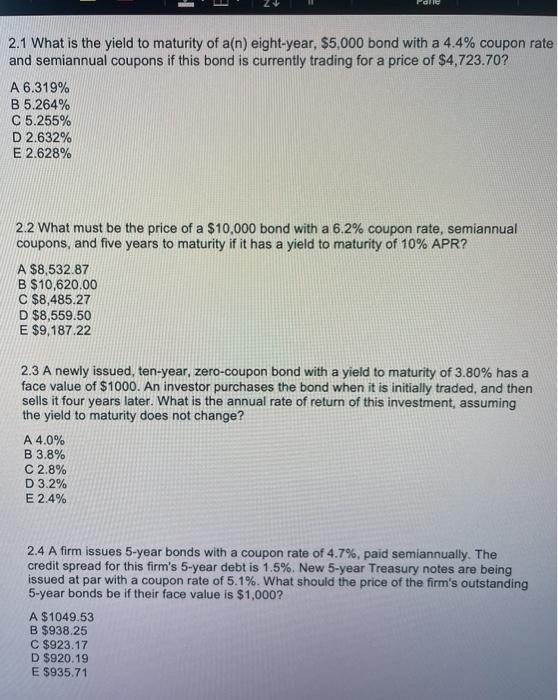

Bond Prices: Annual Vs. Semiannual Payments | Pocketsense Bond Prices: Annual Vs. Semiannual Payments. Many factors affect bond prices including the market interest rate, the remaining years to maturity, the amount of coupon payments and the frequency of the coupon payments. Bonds normally pay coupon interest semiannually. But assume a bond makes coupon payments annually, and if all else is held equal ... Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000... Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

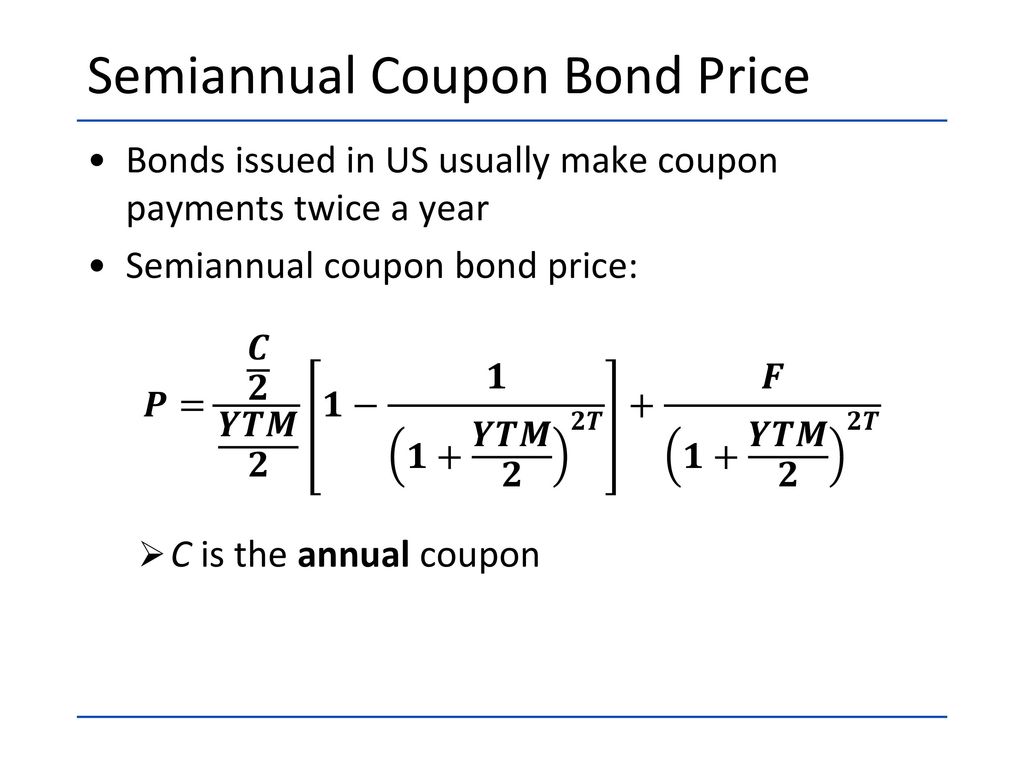

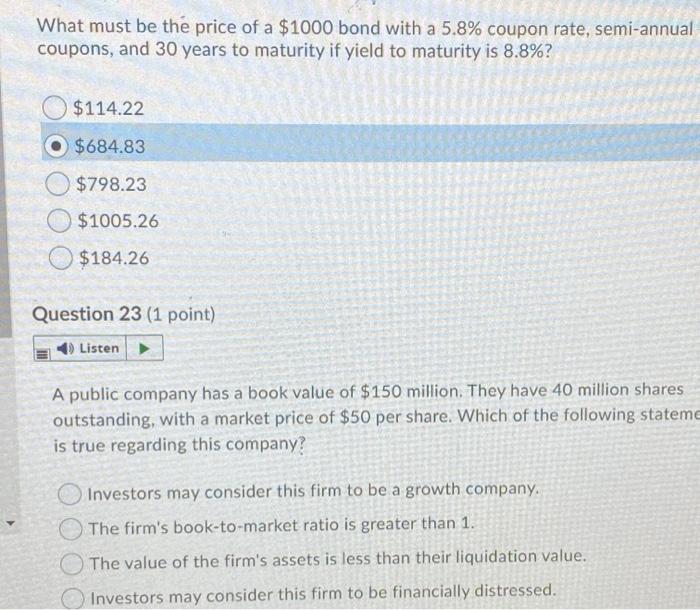

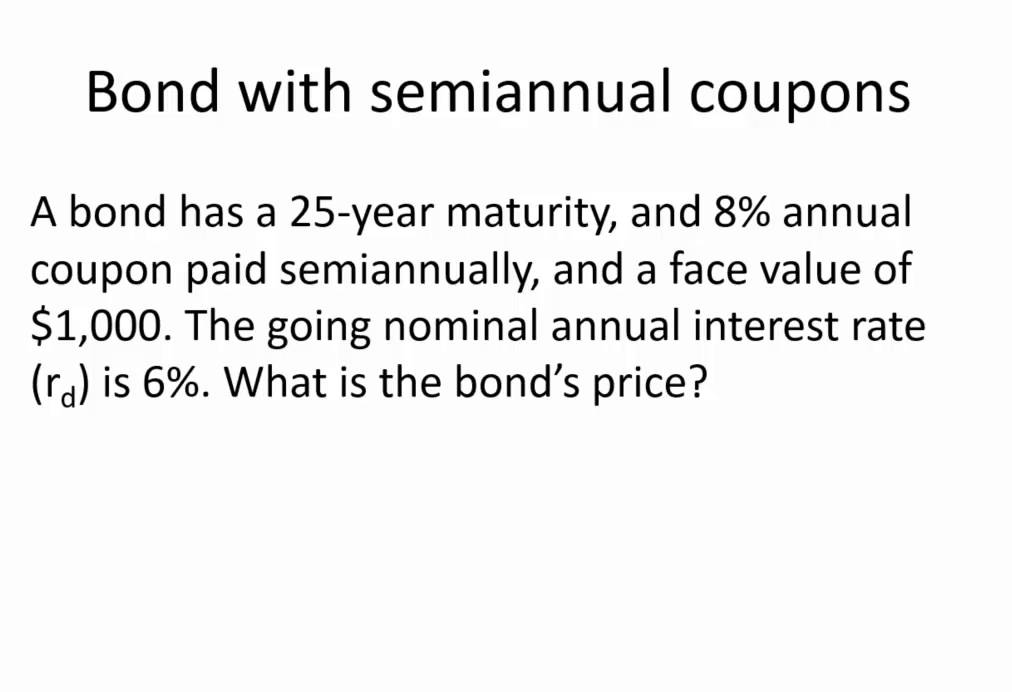

Coupon rate semi annual. How to Calculate the Price of a Bond With Semiannual Coupon Interest ... Therefore, you would use 5 percent as your required rate of return. Converting Payment Periods Because semiannual coupon payments are paid twice per year, your required rate of return, mathematically speaking, must be cut in half. Therefore, the example's required rate of return would be 2.5 percent per semiannual period. Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 Coupon Rate = (20 / 100) * 100; Coupon Rate = 20%; Now, if the market rate of interest is lower than 20% than the bond will be traded at a premium as this bond gives more value to the investors compared to other fixed income securities. However, if the market rate of ... Zero Coupon Bond Calculator - Nerd Counter When we aim to get a zero coupon bond price calculator semi-annual, the easy way is to have the coupon rate on the bond and then divide it by the present price of the bond to obtain yield. ... As coupon rates are fixed in terms of yearly interest payments, that's why it is necessary to divide the rate by two, to have the semi-annual payment ... Coupon Bond Questions and Answers | Homework.Study.com How much will the coupon payments be of a 25 year $5,000 bond with a 8% coupon rate and semi annual payments? A. $800 B. $400 C. $200 D. $67 . View Answer. ... A certain 6% annual coupon rate convertible bond (maturing in 20 years) is convertible at the holder's option into 20 shares of common stock. The bond is currently trading at $800.

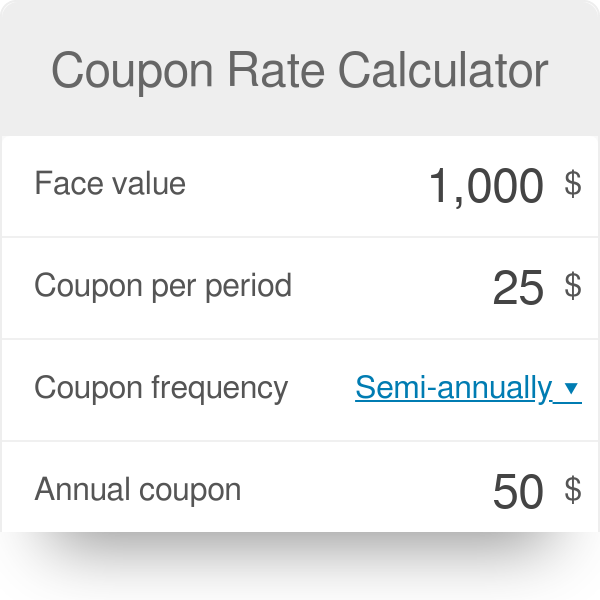

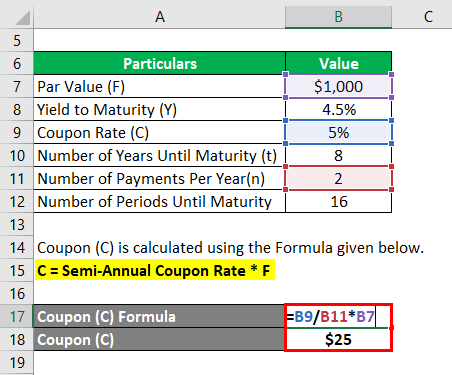

Coupon Rate Calculator | Bond Coupon annual coupon payment = coupon payment per period * coupon frequency As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate The last step is to calculate the coupon rate. Coupon Rate: Formula and Bond Yield Calculator - Wall Street Prep Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000 Since most bonds pay interest semi-annually, the bondholder receives two separate coupon payments of $3k each year for as long as the bond is still outstanding. Number of Periods (N) = 2 Coupon Payment = $6,000 / 2 = $3,000 Bond Coupon Rate Calculation Steps Assume coupons paid semi-annually, coupon rates and | Chegg.com The bond is callable in 8 years (after the 16th coupon payment) at par. If the yield rate is 3%, how much should investors pay for; Question: Assume coupons paid semi-annually, coupon rates and yields quoted with semi-annual compounding, and redeemable at par unless otherwise noted. A municipality issues a $100 par value bond paying a 5% coupon ... Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... TIPS: TIPS pay a regular semi-annual coupons while the principal can be redeemed at the greater of the original principal amount or their inflation-adjusted equivalents. FRN: Floating rate notes pay quarterly interest based on discount rates for 13-week treasury bills, with the principal paid at maturity.

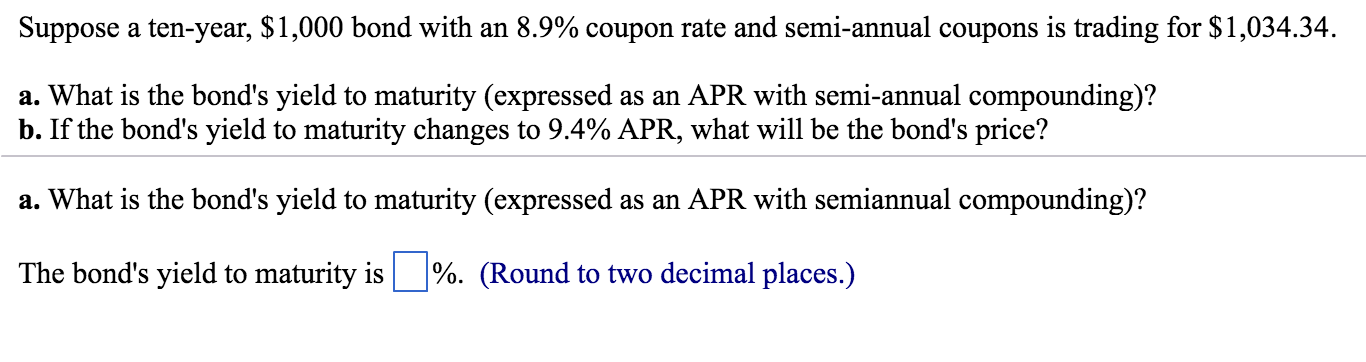

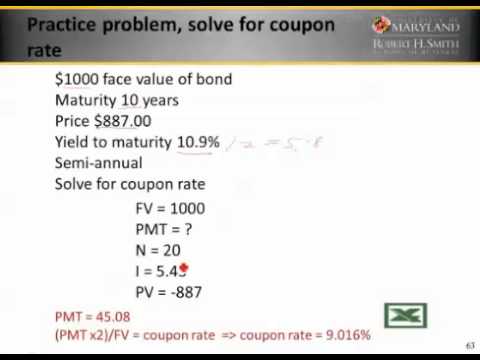

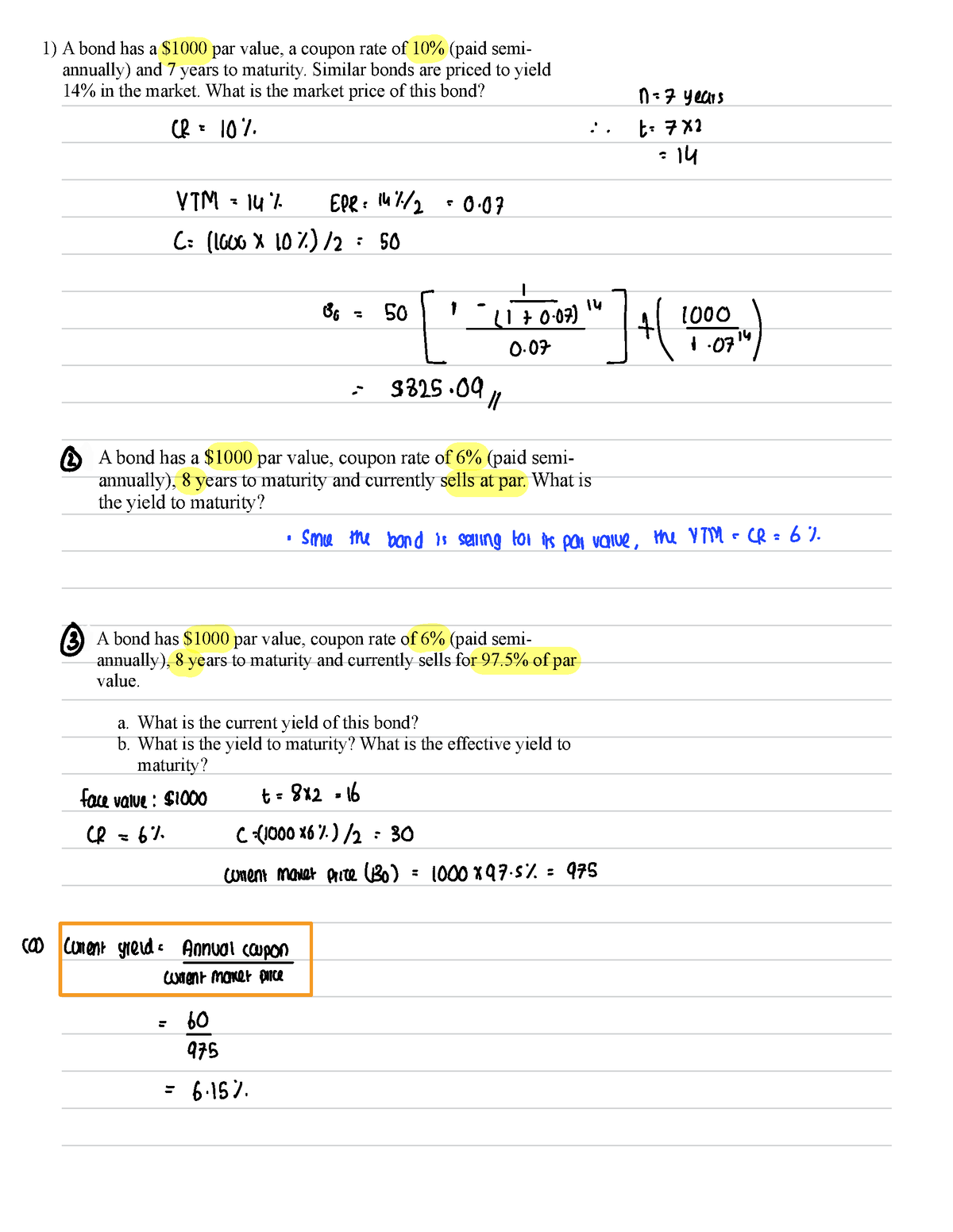

Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM). Coupon Rate Formula | Step by Step Calculation (with Examples) Dave said that the coupon rate is 10.00% Harry said that the coupon rate is 10.53% Annual Coupon Payment Annual coupon payment = 4 * Quarterly coupon payment = 4 * $25 = $100 Therefore, the coupon rate of the bond can be calculated using the above formula as, Coupon Rate of the Bond will be - Therefore, Dave is correct. PRACTICE AND CLASS Ch. 6 (Bond valuation) Flashcards | Quizlet Study with Quizlet and memorize flashcards containing terms like Bonds practice (ch.6) 1. What is the YTM of a $1,000 par value bond with an 8% coupon rate, semi-annual coupon payments, and 10 years to maturity if the bond currently sells for $950?, Bonds practice (ch.6) 2. A bond is sold at $1,050.50 which has a face value of $1,000 and a coupon rate of 5% paid semi-annually. It will mature ... Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator Online coupon rate calculation. Use this simple finance coupon rate calculator to calculate coupon rate.

Bond Price Calculator Coupon rate is the annual rate of return the bond generates expressed as a percentage from the bond's par value. Coupon rate compounding frequency that can be Annually, Semi-annually, Quarterly si Monthly. Market interest rate represents the return rate similar bonds sold on the market can generate.

Semi-annual rate - ACT Wiki - Treasurers The semi-annual rate is the simple annual interest quotation for compounding twice a year. Coupon rates on bonds paying interest twice per year are generally expressed as semi-annual rates. This makes rates broadly comparable, while also enabling the amounts of fixed interest coupons to be determined easily. Example: Semi-annual rate calculation

Bond Price Calculator - Belonging Wealth Management If your bond has a face, or maturity, value of $1,000 and a coupon rate of 6% then input $60 in the coupon field. Compounding Frequency For most bonds, this is semi-annual to coincide with the fact that you receive two annual coupon payments. The calculator will make the necessary adjustments to your annual coupon if you select this option.

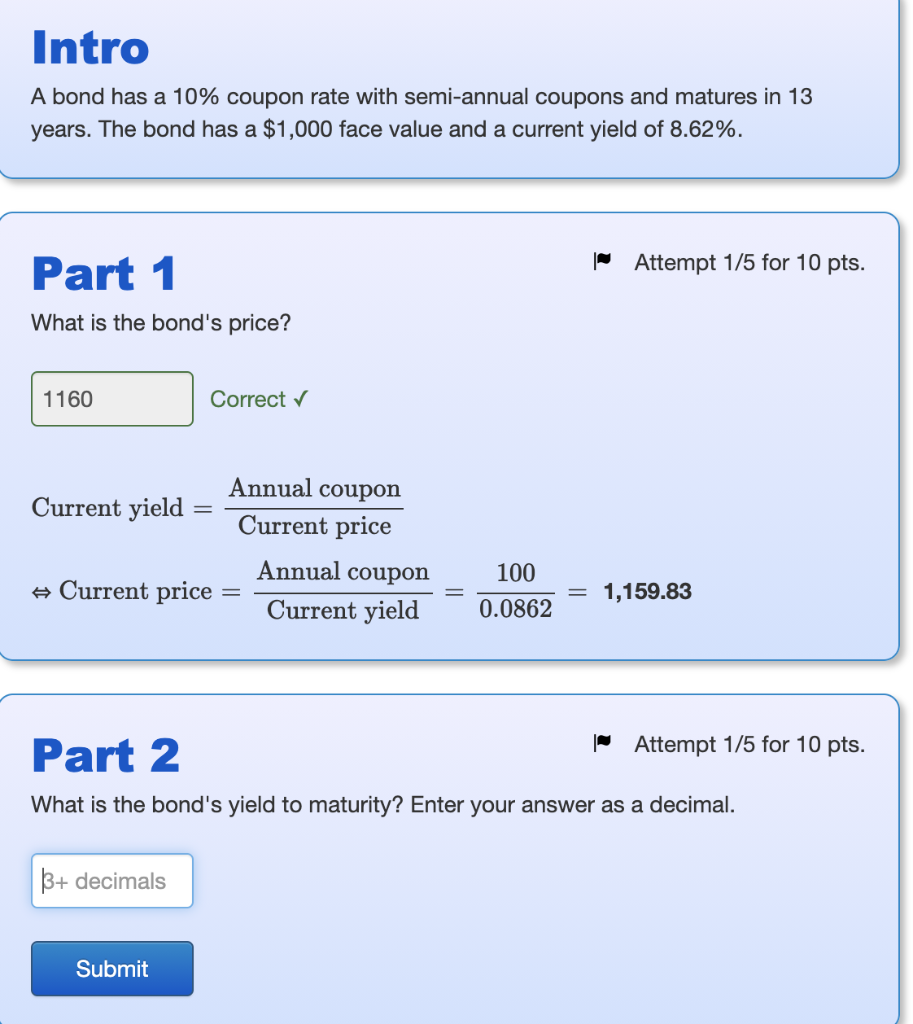

Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for...

Semi-Annual Coupon Rate Definition | Law Insider Semi-Annual Coupon Rate means for each Reference Asset, the rate (expressed as a percentage) set forth in the table below: Sample 1 Sample 2 Based on 1 documents Remove Advertising Semi-Annual Coupon Rate Average Annual Debt Service Average Annual Compensation Maximum Annual Debt Service Calculation Rate Payment Rate

Effective Annual Yield - Definition, Formula, and Example Suppose an investor purchase a bond issued by ABC company. The Bond has a coupon rate of 8%. Scenario # 1: The bond makes an annual payment. Effective annual yield = [1 + (r/n)] n - 1. Effective annual yield = [1+ (8%/1)] 1 - 1 = 8%. Since there is no compounding effect for a coupon received after one year, the EAR is the same as the coupon ...

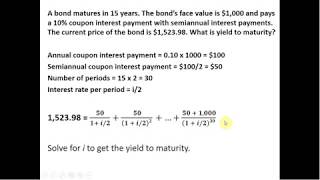

Yield to Maturity Calculator | Good Calculators C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity. Example 2: Suppose a bond is selling for $980, and has an annual coupon rate of 6%. It matures in five years, and the face value is $1000.

Solved 1. Analyze the 20-year, 8% coupon rate (semi-annual | Chegg.com 1. Analyze the 20-year, 8% coupon rate (semi-annual payment), $1,000 par value bond. The bond currently sells for $1,115. What's the bond's yield to maturity?

Coupon Bond - Guide, Examples, How Coupon Bonds Work The issuer of the bond agrees to make annual or semi-annual interest payments equal to the coupon rate to investors. These payments are made until the bond's maturity. Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value.

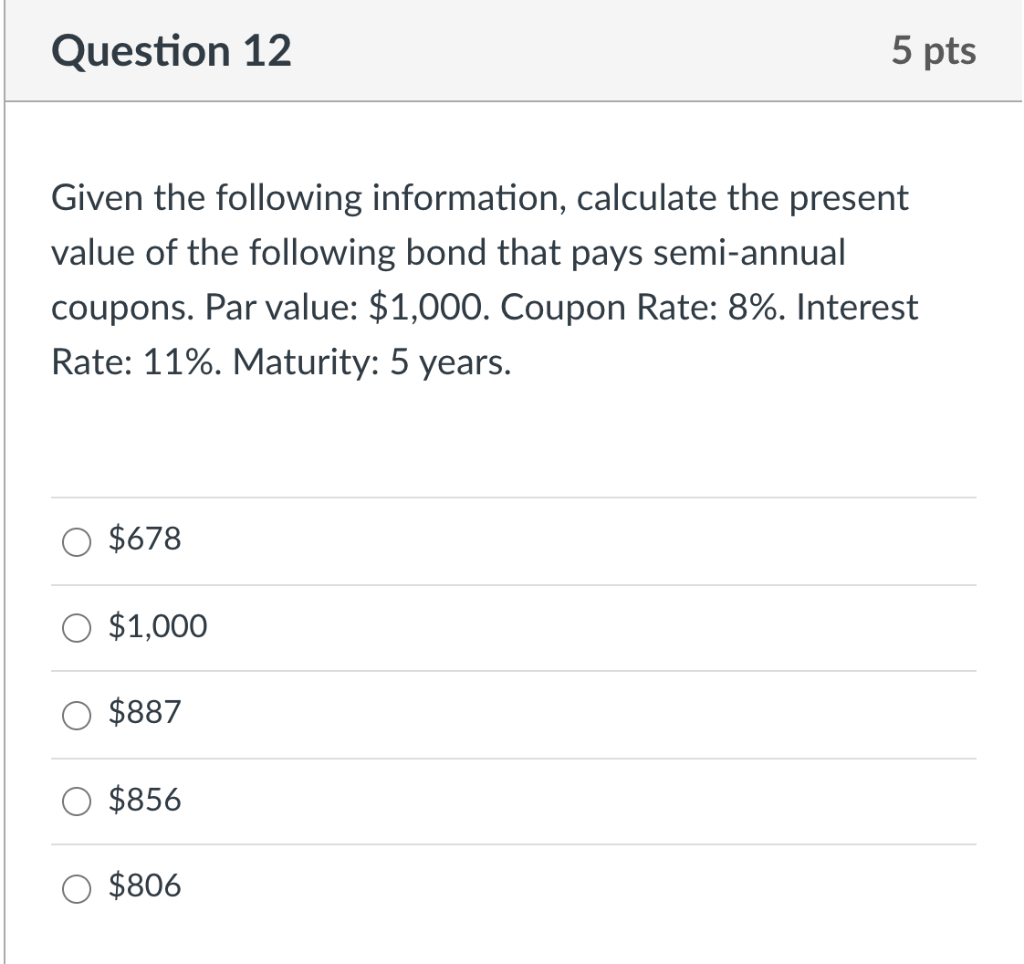

How to Calculate the Price of Coupon Bond? - WallStreetMojo Let us take an example of bonds issued by company ABC Ltd that pays semi-annual coupons. Each bond has a par value of $1,000 with a coupon rate of 8%, and it is to mature in 5 years. The effective yield to maturity is 7%. Determine the price of each C bond issued by ABC Ltd. Below is given data for the calculation of the coupon bond of ABC Ltd.

Coupon Rate - Meaning, Calculation and Importance - Scripbox The coupon payments are semi-annual, and the semi-annual payments are INR 50 each. To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%.

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000...

Bond Prices: Annual Vs. Semiannual Payments | Pocketsense Bond Prices: Annual Vs. Semiannual Payments. Many factors affect bond prices including the market interest rate, the remaining years to maturity, the amount of coupon payments and the frequency of the coupon payments. Bonds normally pay coupon interest semiannually. But assume a bond makes coupon payments annually, and if all else is held equal ...

![Solved] 2)Colliers Concord Ltd. has recently issued a bond ...](https://www.cliffsnotes.com/tutors-problems/assets/img/attachments/24859591.jpg)

Post a Comment for "40 coupon rate semi annual"