41 zero coupon bonds duration

The One-Minute Guide to Zero Coupon Bonds | FINRA.org After 20 years, the issuer of the bond pays you $10,000. For this reason, zero-coupon bonds are often purchased to meet a future expense such as college costs or an anticipated expenditure in retirement. Federal agencies, municipalities, financial institutions and corporations issue zero-coupon bonds. Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia The Vanguard Extended Duration Treasury ETF ( EDV) went up more than 55% in 2008 because of Fed interest rate cuts during the financial crisis. 5 The PIMCO 25+ Year Zero Coupon U.S. Treasury Index...

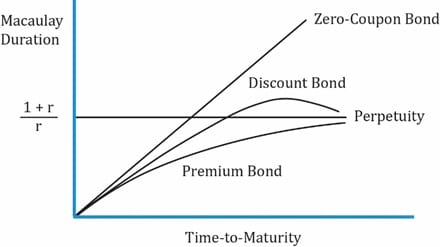

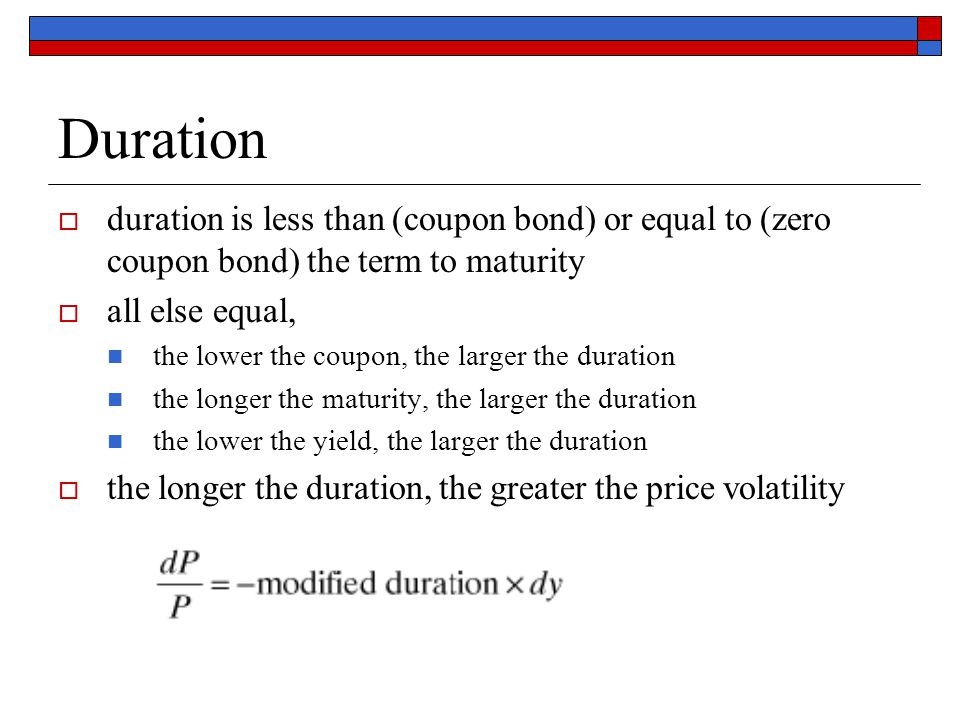

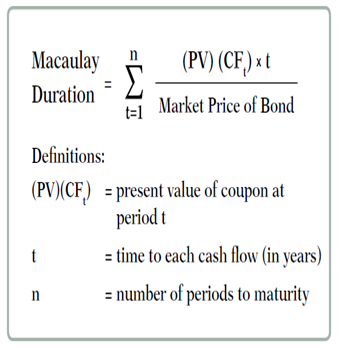

duration of zero coupon bonds | Forum | Bionic Turtle The Macaulay duration of a zero-coupon bond equals its maturity, such that the Mac duration of a zero-coupon bond must be monotonically increasing, and. DV01 = Price * Mod duration /10000, where in the case of a zero coupon bond: Price is a decreasing function of maturity (i.e., a zero is acutely "pulled to par"), but Mod duration is an ...

Zero coupon bonds duration

Duration and Zero Coupon Bonds - YouTube Examples of Macaulay duration are given for zero coupon bonds. Solved 37. What is the duration of a zero-coupon bond that | Chegg.com Question: 37. What is the duration of a zero-coupon bond that has 7 years to maturity? What is the duration if the maturity increases to 10 years? If it increases to 12 years? (니 \ ( L G \) 3-7) This problem has been solved! See the answer, Show transcribed image text, Expert Answer, 100% (1 rating) Zero-coupon bond - Wikipedia A zero coupon bond always has a duration equal to its maturity, and a coupon bond always has a lower duration. Strip bonds are normally available from investment dealers maturing at terms up to 30 years. For some Canadian bonds, the maturity may be over 90 years. [citation needed]

Zero coupon bonds duration. What is the duration of a zero coupon bond? - Quora Originally Answered: what is the duration of a zero coupon bond? Zero coupon bond can be of any duration , can be from one year to 10 years. It is ordinarily from 3 to 5 years. Zero coupon bonds are issued at a discount with par value paid on redemption, sometimes with a nominal premium. What are Zero-Coupon Bonds? (Definition, Formula, Example, Advantages ... With zero-coupon bonds, the bondholders need to pay taxes associated with interest income, even though the particular gain has been realized or not. For example, with a bond that matures in 5 years, the lump sum return will only be generated at the end of the period. However, the bondholder must pay taxes, regardless of the time to maturity. Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19, Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. fixed income - Duration of callable zero coupon bond - Quantitative ... fixed income - Duration of callable zero coupon bond - Quantitative Finance Stack Exchange. 1. Can anybody please help me out with the below question with a brief explanation:-. A 10-year zero coupon bond is callable annually at par (its face value) starting at the beginning of year 6. Assume a flat yield curve of 10%.

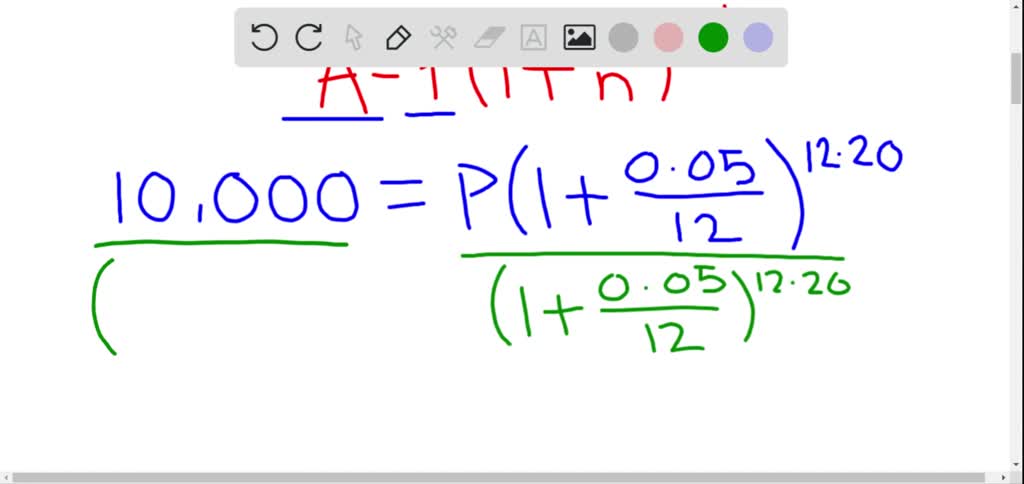

Zero-Coupon Bond Primer: What are Zero-Coupon Bonds? - Wall Street Prep Generally, zero-coupon bonds have maturities of around 10+ years, which is why a substantial portion of the investor base has longer-term expected holding periods. Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53, The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding, How to Invest in Zero-Coupon Bonds - US News & World Report Zeros are purchased through a broker with access to the bond markets, or with an actively managed mutual fund or and index-style product like an exchange-traded fund. PIMCO 25+ Year Zero Coupon US ... Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ Zero coupon bonds have a duration equal to their time until maturity, unlike bonds which pay coupons. Duration of a bond is a length of time representing how sensitive a bond is to changes in interest rates.

Bond Duration Calculator - Macaulay and Modified Duration - DQYDJ From the series, you can see that a zero coupon bond has a duration equal to it's time to maturity - it only pays out at maturity. Example: Compute the Macaulay Duration for a Bond. Let's compute the Macaulay duration for a bond with the following stats: Par Value: $1000; Coupon: 5%; Current Trading Price: $960.27; Yield to Maturity: 6.5% ... What Is Bond Duration? Definition, Formula & Examples What Is Bond Duration? Definition, Formula & Examples TheStreet Staff; Oct 3, 2022 Oct 3, 2022 Updated 19 hrs ago; Facebook ... Zero-coupon Bond; Maturity Date; Value; Price; Investment; What Is a Zero-Coupon Bond? Definition, Characteristics & Example Typically, the following formula is used to calculate the sale price of a zero-coupon bond based on its face value and maturity date. Zero-Coupon Bond Price Formula, Sale Price = FV / (1 + IR) N,... Zero Coupon Bond | Investor.gov The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years. These long-term maturity dates allow an investor to plan for a long-range goal, such as paying for a child's college education. With the deep discount, an investor can put up a small amount of money that can grow over many years.

Zero Coupon Bond Calculator - Nerd Counter Zero-Coupon Bond Yield = F 1/n, PV - 1, Here; F represents the Face or Par Value, PV represents the Present Value, n represents the number of periods, I feel it necessary to mention an example here that will make it easy to understand how to calculate the yield of a zero-coupon bond.

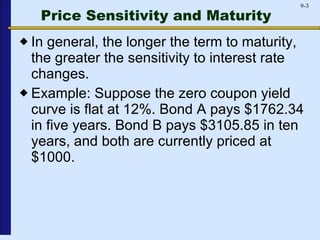

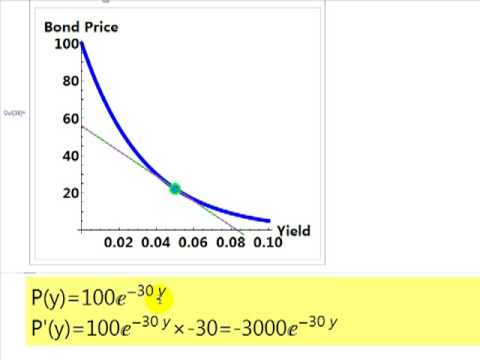

Bond Duration - Investment FAQ For example, a 30 year bond with a 7% coupon and a 6% YTM has a duration of only 14.2 years. However, a zero will have a duration exactly equal to its maturity. A 30 year zero has a duration of 30 years. Keeping in mind the rule of thumb that the percentage price change of a bond roughly equals its duration times the change in interest rates ...

Bond duration - Wikipedia For a standard bond, the Macaulay duration will be between 0 and the maturity of the bond. It is equal to the maturity if and only if the bond is a zero-coupon bond. Modified duration, on the other hand, is a mathematical derivative (rate of change) of price and measures the percentage rate of change of price with respect to yield.

Zero-Coupon Bond Definition - Investopedia The maturity dates on zero-coupon bonds are usually long-term, with initial maturities of at least 10 years. These long-term maturity dates let investors plan for long-range goals, such as saving...

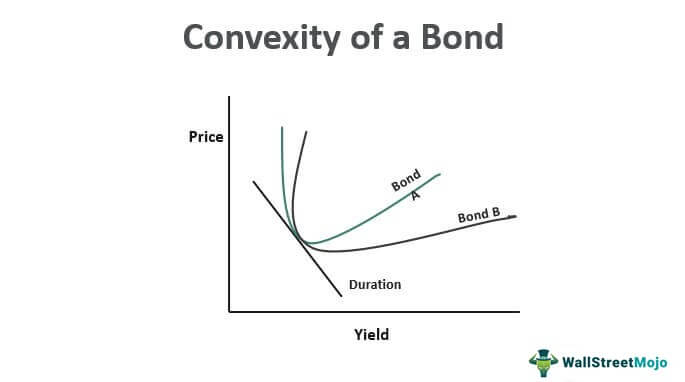

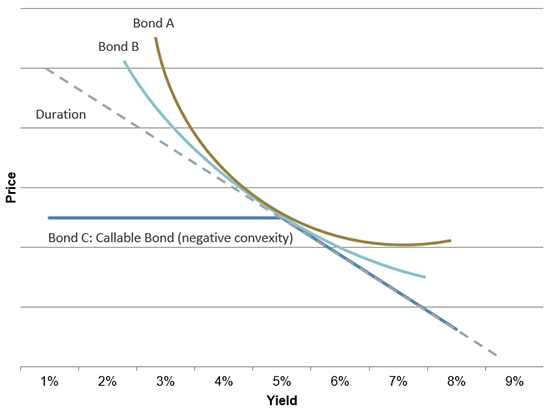

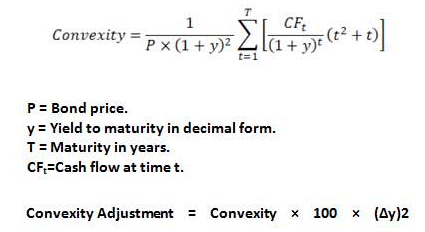

PDF Understanding Duration - BlackRock Duration can help predict the likely change in the price of a bond given achange in interest rates. As a general rule, for every 1% increase or decreasein interest rates, a bond's price will change approximately 1% in the oppositedirection for every year of duration. For example, if a bond has a duration of 5 years, and interest rates increase b...

How to Calculate Bond Duration - wikiHow These "zero-coupon" bonds are sold at a deep discount to par when issued, but can be sold at their full par value when they mature. 3, Clarify coupon payment details. To calculate bond duration, you will need to know the number of coupon payments made by the bond.

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Zero coupon bonds do not pay interest throughout their term. Instead interest is accrued throughout the bond's term & the bond is sold at a discount to par face value. After a user enters the annual rate of interest, the duration of the bond & the face value of the bond, this calculator figures out the current price associated with a specified ...

Solved The dollar duration of a zero-coupon bond Select one: | Chegg.com The dollar duration of a zero-coupon bond Select one: a. None of the other statements is correct. b. does not reflect the dollar value change in the bond's price with respect to a 100-basis-point change in interest rates c. measures the slope of the price-yield function at a given level of yield, i.e. ∂P /∂R d. is equal to the maturity. e.

Zero-coupon bond - Bogleheads Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value. ... For instance, a 30-year bond with a 5% coupon has a duration of just over 15 years; by contrast, a 30-year zero has a duration of 30 years. Therefore, in a deflationary crisis ...

Zero Coupon Bond Modified Duration Formula - Bionic Turtle We barely need a calculator to find the modified duration of this 3-year, zero-coupon bond. Its Macaulay duration is 3.0 years such that its modified duration is 2.941 = 3.0/ (1+0.04/2) under semi-annually compounded yield of 4.0%. If you are interested in a further discussion of the difference between Macaulay, modified and effective duration ...

Zero-coupon bond - Wikipedia A zero coupon bond always has a duration equal to its maturity, and a coupon bond always has a lower duration. Strip bonds are normally available from investment dealers maturing at terms up to 30 years. For some Canadian bonds, the maturity may be over 90 years. [citation needed]

Solved 37. What is the duration of a zero-coupon bond that | Chegg.com Question: 37. What is the duration of a zero-coupon bond that has 7 years to maturity? What is the duration if the maturity increases to 10 years? If it increases to 12 years? (니 \ ( L G \) 3-7) This problem has been solved! See the answer, Show transcribed image text, Expert Answer, 100% (1 rating)

Duration and Zero Coupon Bonds - YouTube Examples of Macaulay duration are given for zero coupon bonds.

:max_bytes(150000):strip_icc()/dotdash_Final_Duration_Aug_2020-01-2893c21887d14bb3a81e0a2544fc13c4.jpg)

Post a Comment for "41 zero coupon bonds duration"